RSF Association Finances

The RSF Association is an HOA which operates a golf course, a private restaurant, a tennis club, a horse ranch, sports fields, 65 miles of horse trails, and several open space hiking parks, among other ammenities. It also provides a private security service and runs a building department which reviews and issues building permits.

It does all this on a $33M annual revenue total budget, of which $10M comes from HOA dues (these numbers for FY 2026). The $23M of annual revenue not coming from assessments comes from club memberships and user fees. On a per property basis, this equates to HOA dues of about $408 per month from the approximately 2,044 HOA Member properties.

The HOA employs approximately 179 employees (FY26) comprised of management, restaurant employees, golf course maintenance, parks and recreation, club employees, security force, building department, etc.

As you can see from these numbers, the RSFA is a significant operating business requiring sophisticated professional management.

Assessments

The RSFA is unusual for an HOA in that it assesses HOA dues based on property tax value. All other California HOAs assess their Members the same amount per property or based on objective non changing criteria like condo floor size or lot size.

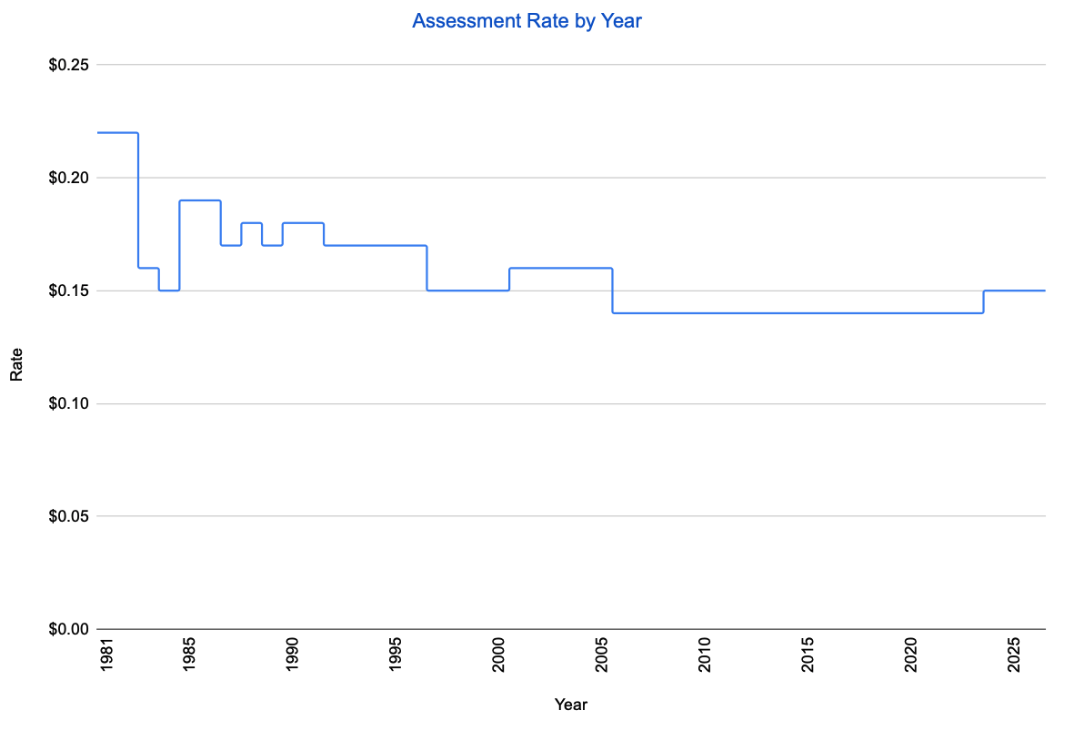

In fiscal 2026, the RSFA assessed every property $0.15 per $100 of County assessed property value. Or in other words, 0.15% of property value. This can be compared to 1% of assessed property value that you pay in property tax.

Due to the way property taxes are calcuated via Prop 13 passed in the 1970s and the many subsequent modifications to it, new Members who recently purchased a home in Rancho typically pay far more in RSFA dues than Members who have remained in their houses for decades.

Budget

The RSFA fiscal year runs from July 1 through June 30, to mirror property tax collections. It prepares a yearly budget which must be approved by the Board of Directors and be mailed out to all Members by May 31st. The budget is just a plan for the next fiscal year and actual spending, collections and revenue may differ materially from the budget.

Budget creation starts with high level strategic objectives as set by the Board. Staff then work with each department head to create spending and revenue estimates for the following year. As such, the budget is mostly a staff creation, with overall strategic input from the Board. The RSFA's Audit Finance committee reviews the budget over several meetings as more detail gets added.

Very often, the approved budget will appear to not contain assessment increases because the 0.15% (or whatever it was the previous year) rate doesn't change, but of course property values typically go up from year to year, and some small percentage of homes get sold, resetting property values to a much higher number. So even when the rate doesn't change, it typically results in a 4% to 8% budget increase.

California HOA law restricts HOAs from increasing yearly assessments more than 20% (on a dollar basis) unless Members vote otherwise. HOAs can also assess special assessments at any time, but again these are restricted to 5% of the total HOA yearly expenses unless Members vote otherwise. For RSFA, the 5% number would be 5% of the total budgetary expenses, which was $34M in fiscal 2025, meaning the HOA Board could have assessed a special assessment of about $1.7M, which would still be assessed proportionally according to County property tax value as per the Covenant language.

Replacement Reserves

Replacement Reserves, or often just called reserves, are a California law mandated fund that each HOA must pay into to pay for expected end of life replacements. For the RSFA it would be for golf equipment, golf carts, tennis nets, playing surface, horse arena footing, fencing, HVAC units, etc. It is recommended that HOAs keep their reserve fund at 70% funded, but the RSFA has historically strived to keep theirs funded at 100%.

Club Finances

As of fiscal 2025, the RSFA has three clubs that charge their members or users fees: The Golf Club, the Tennis Club and the Osuna Ranch horse facility.

For the last 40+ years, the Association has required these clubs to self fund and not draw any assessment money for their operations or even major capital upgrades. Thus for instance, the golf club funded a major golf course remodel in 2021 entirely through club member fees. It also built a major new clubhouse building in 2007, also with no Member assessments. Likewise the Tennis Club and Osuna Ranch are self funded.

Restaurant Finances

All Association Members have dining priviledges at the private ranch clubhouse restaurant. Like almost all private restaurants, the restaurant runs at a deficit. Each year, $500K of assessment money is used to defray these operating deficits, with the remainder (typically $800K to $1M) borne by the Golf Club.

Other Ammenity Finances

The Association operates many non-revenue generating ammenities such as the soccer fields, the baseball diamonds, the 65 miles of horse trails, the private security Patrol, and various open space hiking parks. These are all paid for through regular yearly Member assessments.

Chronicles

Chronicles